Students Cash In on Bank Experience

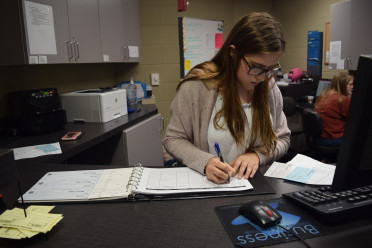

Students in Kansas are gaining real-world banking experience at their schools. Student-run banks provide opportunities for high schoolers to bring their coursework to life. Plus, many leverage their experience to gain clarity about and even launch careers after school.

Washburn Rural and Silver Lake high schools both operate student banks sponsored by Silver Lake Bank. The banks operate as scaled-down versions of a typical bank, with simple savings accounts for teachers and students. The banks — run by juniors and seniors taking accounting and business classes — are supervised by faculty with the backing of Silver Lake Bank.

In addition to providing participating students with hands-on experience, the banks also serve as a mechanism to teach other students valuable lessons in saving and personal finance.

How Student Banks Work

Kansas state banking laws have a provision that allows for the operation of student banks. At Washburn Rural and Silver Lake schools, getting the banks up and running was a community effort involving teachers, principals, superintendents and a local bank.

Kansas state banking laws have a provision that allows for the operation of student banks. At Washburn Rural and Silver Lake schools, getting the banks up and running was a community effort involving teachers, principals, superintendents and a local bank.

“As a community bank, we try to add value for our customers,” said Shane C. Koci, vice president and online banking services manager at Silver Lake Bank. “One of the things that we are very passionate about is financial literacy. So, we thought, ‘What can we do to help schools launch a financial literacy campaign in a fun and interesting way that would get students excited about learning?’”

Silver Lake Bank provided support to help get the banks up and running, including everything from financial support to policies and procedures. Startup financial needs vary by school, including help setting up suitable rooms within the schools and supplying vaults and cash drawers. The bank created a simple database for tracking accounts and transactions that mirrors more complex databases used by banks. It also provided training and ongoing guidance as schools make the operations their own.

Students are carefully selected to participate in the banks. At Silver Lake Schools, students must be in the business pathway, take a business essentials class, earn an A in accounting and successfully interview for a position.

“It's become kind of a privilege,” said Brock Leroux, business teacher at Silver Lake Schools. “A lot of kids want it. There are only so many spots available, and I want kids that I can trust in there. So, we have a vetting process.”

Sophomores can apply to participate starting the following year. And students must commit to working in the bank for both their junior and senior years.

Teachers oversee the curriculum and operations, but students handle much of the day-to-day management, with seniors filling leadership roles and teaching incoming juniors the ropes.

“We have four different roles that we rotate through every two weeks,” Leroux said. “I usually assign two students per job and pair a veteran with a newcomer.”

The roles include teller, database administrator, bookkeeper and auditor. This not only exposes students to different positions, responsibilities and skills, but it also provides a built-in mechanism to ensure accuracy and that the books will balance.

“Everything is dual controlled,” explained Brian McFall, business teacher, Washburn Rural High School. “So, every transaction is looked at several times. For example, if a customer makes a deposit, one student processes the paperwork, then another student checks that student's work. After that, someone enters it in the database. Then it goes to another student to be put in the paper ledger.”

The banks operate during free times such as lunch, flex and advisory periods throughout the school year. Some banks provide checking services to groups affiliated with the school such as sports teams and parent-teacher organizations that engage in fundraising. Using the student bank instead of an outside entity simplifies that process.

Washburn Rural and Silver Lake schools have also expanded student-led business opportunities to include T-shirt and coffee shops.

Lessons in Financial Literacy

In general, teachers and parents must balance many responsibilities. Between ensuring state curriculum requirements are met and coordinating countless household activities, important lessons in financial literacy can fall by the wayside both at home and at school. The student banks fill that gap.

“A really important aspect of the bank is getting kids to save,” McFall said. “So, the students work on promoting financial literacy.”

Washburn Rural developed a savings initiative called Jr. Blue Crew. The bank students wanted to show the difference habitual savings can make. They calculated how much money students could save during high school if they put aside a little every month and earned interest. That exercise became part of a schoolwide financial literacy campaign. As part of this initiative, Washburn Rural also developed an incentive program for people who deposit a certain amount every month to be eligible for prize drawings. These initiatives educate and motivate the entire high school.

Washburn Rural developed a savings initiative called Jr. Blue Crew. The bank students wanted to show the difference habitual savings can make. They calculated how much money students could save during high school if they put aside a little every month and earned interest. That exercise became part of a schoolwide financial literacy campaign. As part of this initiative, Washburn Rural also developed an incentive program for people who deposit a certain amount every month to be eligible for prize drawings. These initiatives educate and motivate the entire high school.

“It's been really exciting to see how they've been able to reach not only just the 10 or 12 students that are able to take the banking class, but to extend that to the entire student body,” Koci said.

Koci added that he’s seen the devastating effects not learning these basic financial skills can have. Many Americans are plagued by credit card debt, lack of budgeting and other issues. The school banks help provide a solid foundation that will serve students later in life.

The Washburn Rural bank has also created opportunities for students to participate in DECA conferences and tour the Kansas Bankers Association.

“I like to create opportunities for them that I wish I would’ve had in high school,” McFall said. “What’s good about the bank is, it allows the kids to dive deeper if they want to and really take something on.”

Career Launchpads

In addition to learning how banks operate and gaining skills necessary for a job in banking or accounting, students learn soft skills that help them no matter what career they decide to pursue.

McFall and Leroux both listed many such skills: customer service, communication, problem solving, teamwork, a strong work ethic and even legible handwriting.

“It definitely gives students those on-the-job training opportunities,” McFall said. “We've had several students that have gone and worked in a bank, because they have these skills. And they get to apply what they've learned in their accounting classes, so it's a win-win.”

Some of those students have gone on to work at the very place that helped provide this opportunity — Silver Lake Bank.

“We've hired several students while they were in high school, as they graduated or went on to post-secondary education,” Koci said. “And we have some full-time employees that have gone through all of their schooling and are still with us today.”

“We've hired several students while they were in high school, as they graduated or went on to post-secondary education,” Koci said. “And we have some full-time employees that have gone through all of their schooling and are still with us today.”

Koci shared stories of two former students who leveraged their school bank experience in other fields.

“We have a student who graduated from the Seaman High School bank program, which Silver Lake Bank also sponsors, and she decided she wanted to go into marketing,” Koci said. “There are all kinds of aspects of banking. It's not just credits and debits. There are a lot of hats you can wear, and part of that is marketing and sales. So, she's helped us with creating marketing campaigns.”

The second story hits closer to home. Koci’s son participated in a student bank program.

“He knew all along he did not want to go into banking,” Koci said. “But he had aspirations to be a small business owner someday. When you run a business, finance is a big part of it.”

Koci added that working at the school banks will serve students well regardless of their career choices.

“Finance is always going to be a part of your life, whether personal or professional,” he said. “I think the student bank program is something that will help you no matter where you go in life.”

Plus, students and teachers alike gain a sense of accomplishment from the experience.

“A lot of past students have said this was such a cool experience,” Leroux said. “It's incredibly rewarding. Every teacher gets into teaching to help students and give them the tools to succeed in the future. This program provides students with knowledge they need when they graduate. I would strongly encourage any school, any business teacher in Kansas to reach out and do something like this.”

How to Start a Student Bank at Your School

Would you be interested in launching a bank program at your school? Koci, Leroux and McFall all had the same advice: Reach out.

“If you have any interest in doing this in your school, or if you're a banker in a community and you think this would be valuable for your school and for your community, the first thing to do is reach out, make a connection,” Koci said.

Sit down and talk with a rep at a local bank. If your community bank doesn’t offer such a program, Koci suggested contacting Silver Lake Bank for guidance.

“We would love to push this to every school we can,” he said. “So, we are happy to partner with schools and other banks.”

And it doesn’t matter how big (or small) your school is.

“We're a 6A school, but it's also been done in 1A and 4A schools,” McFall said. “That's so exciting that no matter the size, you can have a school bank, and you can have programs that students can showcase what they've learned and develop those skills.”

If you’re concerned about the budget or staffing required, Koci said there are solutions to overcome those challenges. His advice: Don’t talk yourself out of it.

“It can seem daunting and overwhelming when you first think about it,” Koci added. “But don't let the overwhelming aspect of it prevent you from ever taking that first step.”

Koci said it’s worth taking a little time to explore your options. Talk to your community bank or a teacher running a similar program, tour a student-led bank, ask questions and discuss your needs. Before you know it, you could be launching an invaluable program for your students.